Demystifying Forex Swaps

Demystifying Forex Swaps: Understanding the Ins and Outs

For beginner traders venturing into the world of foreign exchange (forex) markets, the term “swap” might sound like something out of a mystical trading realm. In this article, we will delve into the world of forex swaps, exploring what they are, how they work, and why they matter.

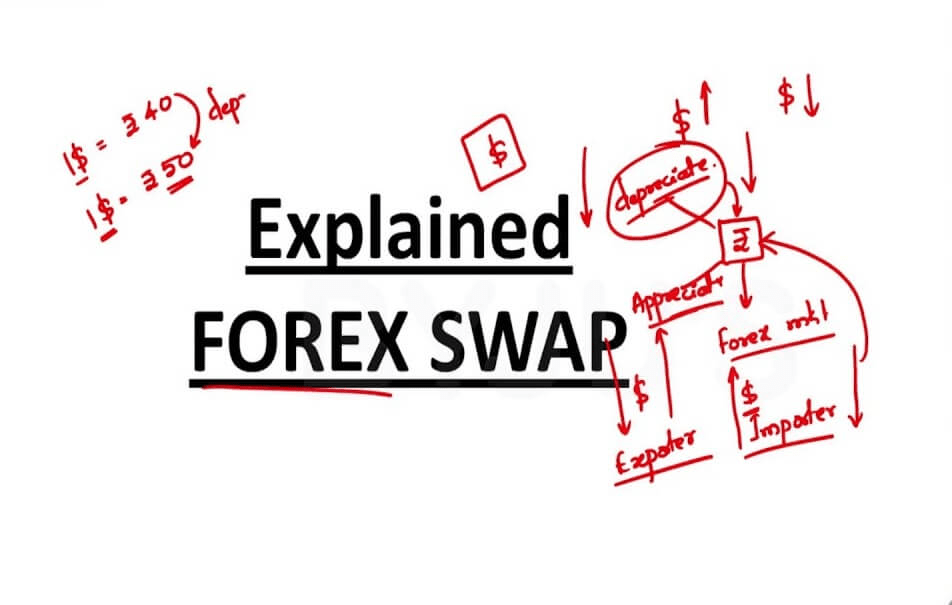

What is a Swap in Forex?

At its core, a swap is a financial instrument utilized in forex trading that involves the exchange of one currency for another over a predetermined period. It enables traders to extend their positions overnight, without having to close and reopen them the following day.

Understanding the Purpose

- Overcoming Time Zone Differences

- Accounting for Interest Rate Differentials

The Mechanics

To comprehend the mechanics of a forex swap, envision a loan between two parties exchanging currencies. When you hold a position overnight, you are essentially borrowing one currency to buy another. The swap rate, also known as the rollover rate, represents the interest rate differential between the two currencies. This rate is calculated based on market conditions and can be positive or negative, depending on the interest rate differentials.

Considerations for Traders

- Swap Points

- Trading Strategy Alignment

- Brokerage Variation

Conclusion

In the vast and intricate world of forex trading, understanding the concept of swaps is a crucial step towards becoming a knowledgeable and successful trader. Swaps play a vital role in overcoming time zone differences and accounting for interest rate differentials, ensuring that you can maintain your positions and adapt to changing market conditions. So, dear traders, armed with this newfound knowledge, go forth and conquer the forex market with confidence, keeping in mind the impact of swaps as you navigate the exciting terrain of currency trading.